Contact us

Within the U.S.

1-855-756-4738

Outside the U.S.

1-303-737-7249

TDD/TTY

1-800-766-4952

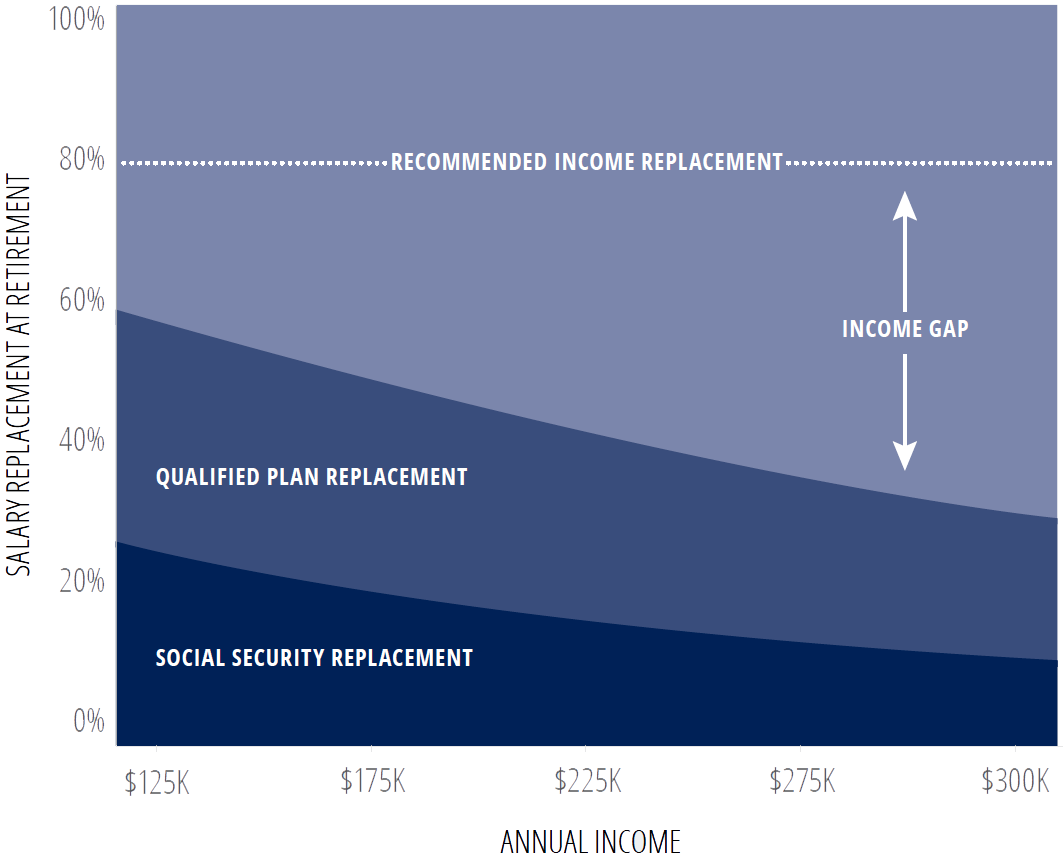

Many financial advisors recommend replacing at least 80% of your annual income today to maintain your current lifestyle in retirement. And the higher your income is now, the harder that can be to achieve. The graph shows the potential retirement savings gap between a replacement goal of 80% and what could be replaced by 401(k) savings and Social Security benefits.

FOR ILLUSTRATIVE PURPOSES ONLY. This hypothetical illustration is intended to show a retirement savings gap at various income levels for a 45-year-old highly compensated employee with an initial 401(k) balance of $50,000 until retirement at age 67, with contributions of the maximum allowed by law as of January 1, 2025 ($23,500 annually with additional catch-up contributions of $7,500 annually after age 50, subject to a limit of 50% of salary). Rate of return of 7% pre-retirement and 6% post-retirement; company match of 5%; salary increase of 3% per year; and inflation rate of 3%. Withdrawal rate begins at 4% and is increased annually by the rate of inflation. Rates of return may vary. The illustration does not represent the performance of any investment options and is not intended to predict or project future investment results. It does not reflect any associated charges, expenses, or fees. The tax-deferred accumulation shown would be reduced if these fees were deducted.

Both plans provide you with a way to plan for retirement on a tax-deferred basis, but there are important and distinguishable differences between them. Following are some of them:

| NONQUALIFIED PLANS | QUALIFIED PLANS (SUCH AS A 401(K) PLAN) |

|

|---|---|---|

| Is there an annual limit on how much income I can defer? | No. Plan limits may apply. | Yes. Subject to annual IRS and defined plan limits. |

| Are balances protected from general creditors in the event of bankruptcy? | No | Yes |

| Do required minimum distribution rules apply? | No | Yes |

| Are there penalties if I withdraw before age 59½? | No | Yes |

| Can I roll over vested balances to an IRA or other qualified retirement plan? | No | Yes |

| Are distribution elections made in advance? | Yes | No |